Validating identifiable opportunities to enhance the Wells Fargo Private Label Credit Card Application experience.

How Might We?

How might we redesign the user flow of the private label credit card application process to foster a seamless and cohesive experience for both merchants and consumers?

PLATFORM

Mobile

TIMELINE

October 2022 - July 2023

ROLE

Lead Product Designer & Research Strategist

CLIENT

Wells Fargo Co.

Immersing ourselves in the problem space

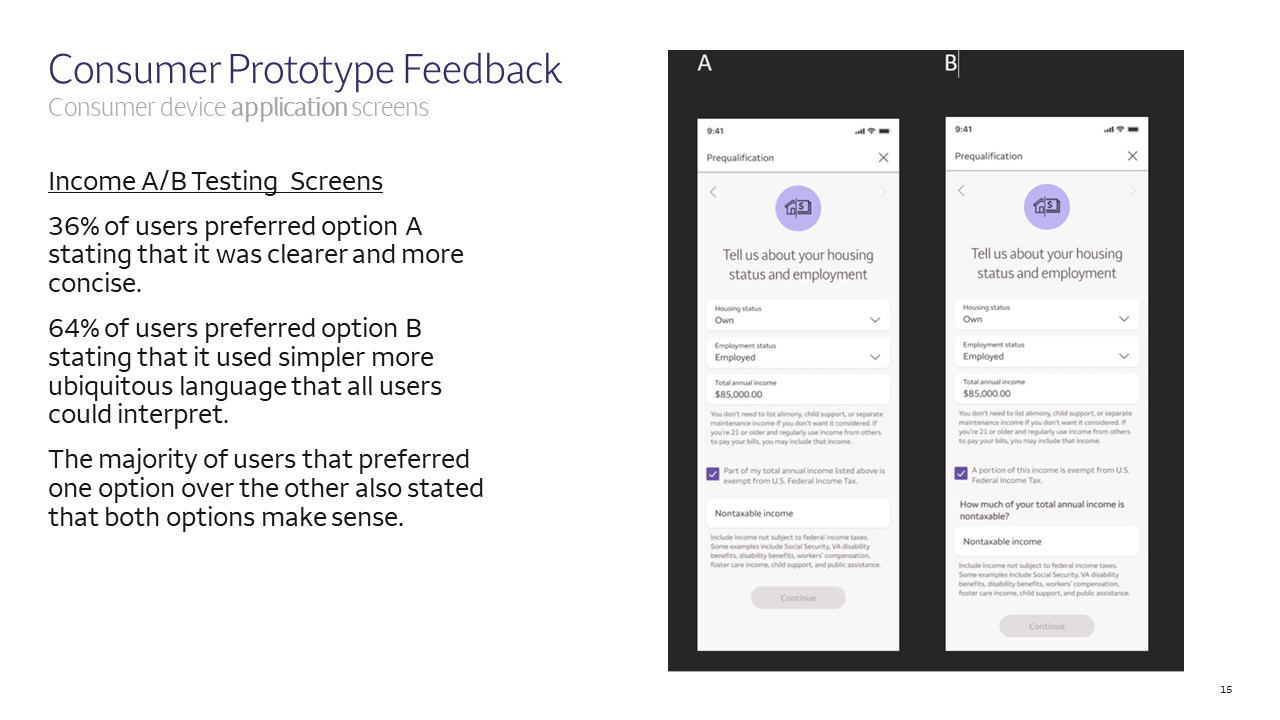

Since the team now had an understanding of the general state of the current PLCC application process and already started iterating on a refined solution, I led them through a usability testing sprint to ensure that the redesigned application process effectively met the needs of the target user groups.

Research methods in this phase included

very structured interviews (moderated and unmoderated), and surveys.

Insights From Initial Generative Research

Users feel overwhelmed and frustrated by the excessive information and fields required, especially on screens with multiple checkboxes and expandable sections for verifying personal details and reviewing terms and conditions.

Users applying with a co-applicant found it tedious to enter similar information twice. The process could be streamlined to avoid redundancy, especially if the co-applicant's information mirrors that of the main applicant.

Users might experience frustration if there are errors or missing information in their application. The design does not clearly indicate how errors are communicated or how users are guided to correct them. This could lead to confusion and incomplete applications.

Information Architecture

User Flows and sequence models were created to help redefine the information architecture and flow of the application. This allowed the team to identify opportunities to improve the navigation in the existing PLCC application process.

Competitive Analysis

Competitive Analysis

I then worked with the team to analyze Citi bank and Discover to review their strengths and weaknesses and identify trends within the market. This helped us to develop additional ways to enhance our business strategy.

-

Competitors were consistent in the uses of personalization throughout the experience.

-

Progress bars or descriptive page headers were used to orient users.

-

The use of cards with shadowing were widely used throughout both competitors applications

Journey Mapping

When I was initially brought onto this project, there was a significant lack of understanding of our user groups.

I collaborated with the stakeholders and designers to create user personas and conduct some team journey mapping sessions to create more alignment.

As a result, this elicited curiosity in the team and new questions and assumptions arose that the team wanted to further validate.

"Pinch" to Zoom or use trackpad and mouse to view details.

Solution

To enhance efficiency and customer retention, we will create a unified and modernized application and transaction experience for WF merchants and prospective private label credit card customers, ensuring consistency across all versions.

This will involve streamlining the user flow, updating the interface to reduce cognitive load, and implementing standardized processes to provide a seamless and reliable experience for all users.

Consumer Device Flow

Merchant Device Flow

Insights From Final Usability Test

After designing the high-fidelity V1 version of the final application, we conducted a final usability test to validate our decisions. The insights from this test can be viewed in the slide deck below.

Business Impact

Increased efficiency of the product team: Getting good answers to learn how to make quick, effective product decisions. Also the team’s focus increased significantly.

Built rapport with existing merchants: Empowered our merchants to speak their mind on the existing process and help make a significant change to it.

Improved cross-functional performance of teams: This process was able to create synergy across the whole organization to help us gain a more well-rounded view of the business.

What I Learned

The Problem

WF Merchants and prospective WF private label credit card customers experience a disjointed and outdated application and transaction experience that is inconsistent across the various merchants. This leads to a decrease in operational efficiency and customer retention.

The Challenge

Upon my involvement, the initial solution was designed solely based on stakeholder requirements and the personal lending design team's assumptions. There was little to no input from merchants and consumers.

Omittment of the discovery stage, and disregarding insight from end users made this product very difficult to use as it significantly increased the cognitive load of users. As a result, the tasks performed by users became increasingly time-consuming, frustrating, and unnecessarily prolonged.

Collaboration is vital and it is important that all parties involved on a project are in constant communication with one another to ensure that there is synergy.

Regular usability testing and prototyping help validate design decisions and identify usability issues early on. By observing users interacting with prototypes, designers can gather valuable insights and make informed design changes.

Designing for accessibility ensures that people with disabilities can access and use the product effectively. Incorporating accessible design principles, such as proper color contrast, keyboard accessibility, and alternative text for images, is important for inclusivity.